Hence if you wish to invest in US. Stocks you may want to avoid dividend.

Indian Income Tax Act 1961 makes it mandatory for all Indian companies and individuals to Withholding Tax Rates in India on all income earned by Foreign Companies NRI from the Indian sources.

. If the gross income is higher than P720000 a 15 withholding tax based on the gross income should be applied. Corporate income tax CIT rates. 1 Avoid dividend stocks listed in the US.

With this law the company has to inform the government on a quarterly basis about income and the amount of withheld tax. How to Pay Less Dividend Withholding Tax. If a stock doesnt pay out dividends you are not subjected to the Dividend Withholding Tax.

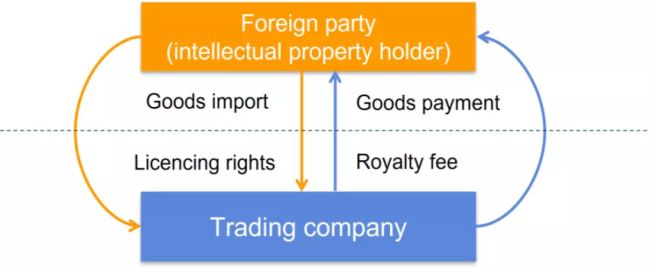

Withholding tax to the Inland Revenue Board of Malaysia IRBM within one month from the date of paying or crediting. Exemption from withholding tax as a result of other exempting provisions of a tax convention other than those given above in codes I and P through R. Generally any person making certain payments such as royalties interest contract payments remuneration to a public entertainer technical and management fees to non-residents is required to remit the tax deducted at an applicable rate ie.

Tax exemption for individuals earning less than P250000. An individual earning less than P250000 a year is exempted from withholding tax where the income is coming only from a single payor ie. 0 0 or 15 10.

0 0 0. Exemption from withholding tax on payments of certain reasonable travel expenses and per diem amounts reimbursed to a non-resident actor. A tax withholding agent.

Description of Withholding tax WHT rates. Tax payable under an assessment upon submission of a tax return is due and payable by the last day of the seventh month from the date of closing of accounts. Malaysia Last reviewed 13 June 2022 Resident.

There are four ways you can reduce the amount of withholding tax on your dividends. Maldives Republic of Last reviewed 06 August 2022. Companies are required to furnish estimates of their tax payable for a year of assessment no later than 30 days before the beginning of the basis period normally the financial year.

Corporate income tax CIT due dates.

Gbci 2022 Complexity In Accounting And Tax Tmf Group

How To Mitigate The Risks Of Double Taxation On Royalty Fees Tax Authorities China

How To Pay Withholding Tax Updated May 2022 Treey Consultancy

Withholding Tax Service Tax On Imported Services For Digital Ads Services

Zach Grau Business Development Analyst Globetax Linkedin

What Is The Double Entry For Withholding Tax Quora

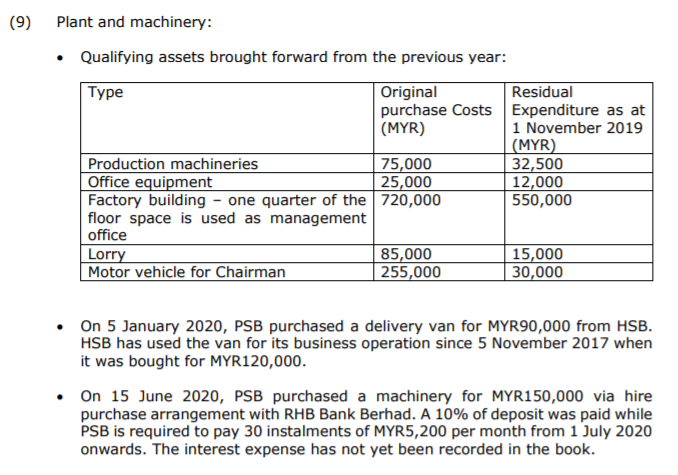

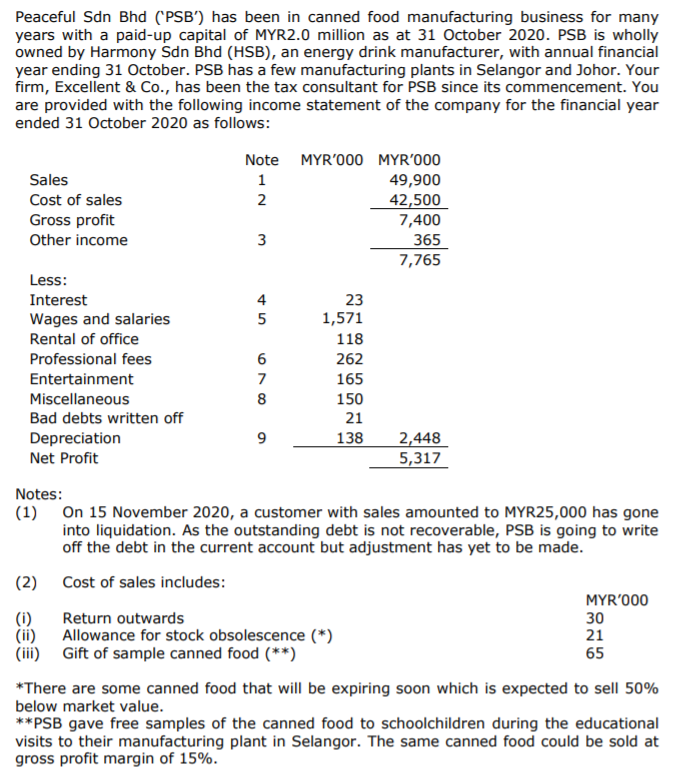

This Is Malaysia Tax Question It Is A Very Long Chegg Com

Kemm Advisory 什么是withholding Tax Facebook

How To Pay Withholding Tax Updated May 2022 Treey Consultancy

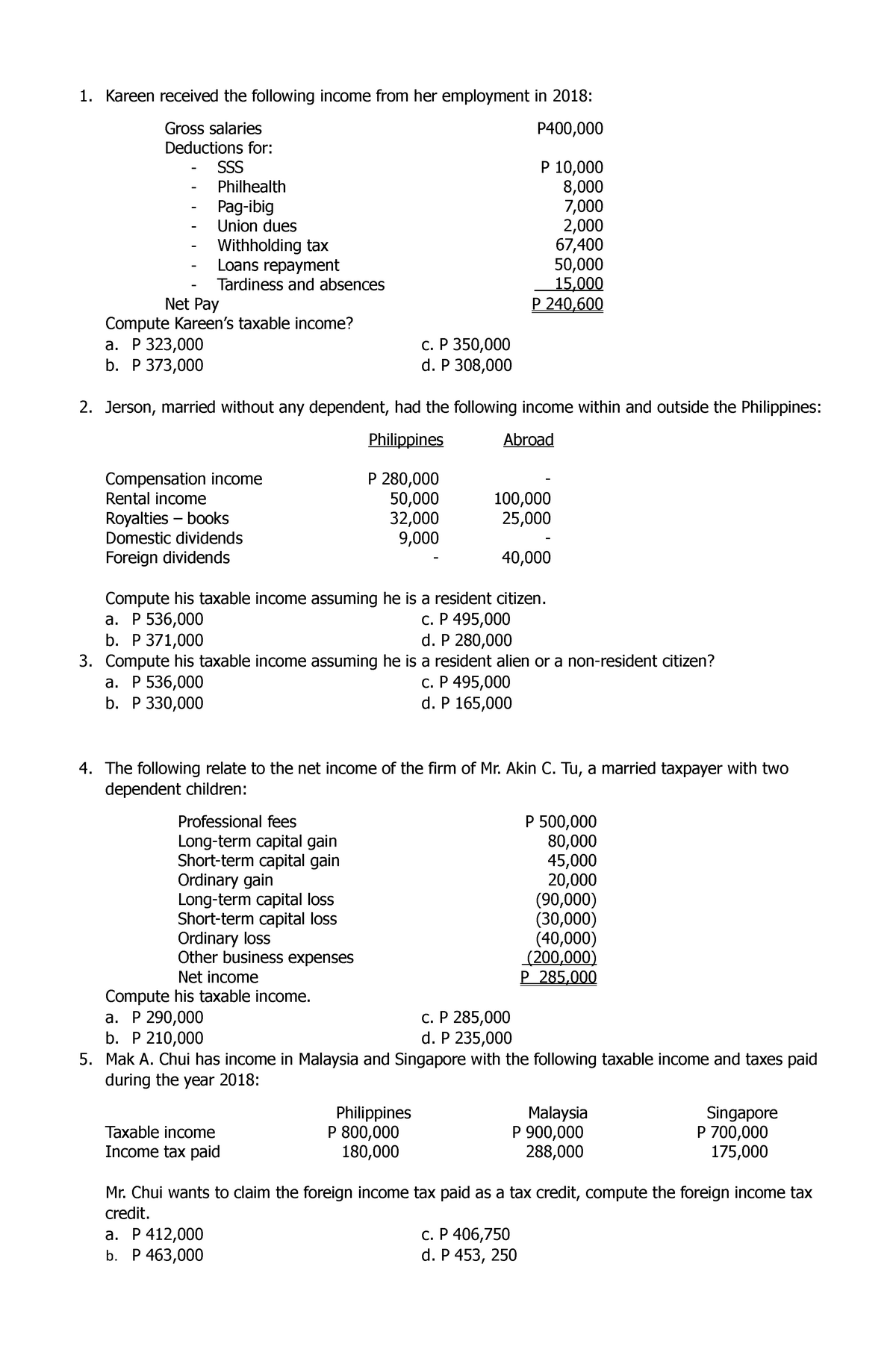

Taxon Nov 12 Income Tax Summaries Kareen Received The Following Income From Her Employment In Studocu

Malaysia Highlights Of The Finance Bill 2016 Conventus Law

Wolters Kluwer Malaysia Cch Books Malaysia Withholding Taxes And The Implications Of Double Taxation Agreements

Withholding Tax Malaysia 2022 Qne Software Sdn Bhd

Withholding Tax Ktp Company Plt Audit Tax Accountancy In Johor Bahru

How To Pay Withholding Tax Updated May 2022 Treey Consultancy

Withholding Tax Ktp Company Plt Audit Tax Accountancy In Johor Bahru

This Is Malaysia Tax Question It Is A Very Long Chegg Com

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary